Navigating Repairs and Maintenance Issues When Buying a Home in Canada

As a Canadian homebuyer, figuring out whether the seller should be responsible for any repairs or maintenance issues discovered during a home inspection or appraisal isn’t always easy. Along with deciding whether the work needs to happen before you buy, you also have to determine how the value of the projects – or the repair request itself – will impact the sale.

If you aren’t sure how to navigate repairs and maintenance issues when buying a home in Canada, here are some tips that can help. Martin Velsen can also help you navigate through the process, so book your appointment here.

Repairs and Maintenance Issues Sellers Should Address

Generally speaking, issues relating to the home’s structure – including the roof, load-bearing walls, and foundation – need to be addressed quickly. If they aren’t handled promptly, a significant amount of damage can occur. Plus, the property might legitimately be unsafe.

Since closing on a house can take a lot of time, requesting the seller handle structure-related problems isn’t a bad idea. That way, you don’t have to worry about the impact of delays or potential safety issues.

Similarly, significant problems with crucial home systems – including electrical, plumbing, and HVAC –commonly fall into the seller’s hands. If those systems are in good working order, the house may become unlivable.

Asking the seller to handle pest infestation-related issues is also wise. Similarly, it isn’t a bad idea to request they deal with any mold, mildew, or drainage problems.

Finally, some mortgage lenders might not approve a loan if certain issues aren’t addressed. Major structural and home system problems can lead to denials. However, those aren’t the only ones. As a result, if you have a lender lined up, you may need to speak with them to determine what repairs or updates they deem mandatory, ensuring you can have them handled by the seller.

When Buyers May Want to Ask for Credits or Price Reductions

If there are repairs or maintenance issues that your lender doesn’t deem mandatory and you’re willing to take on yourself, you have the option of asking for credits or price reductions instead of requesting repairs.

With these, you’re essentially receiving financial compensation for the work you’ll have to take on in the form of closing cost assistance, allowing you to spend less out of pocket. Since closing costs can run from 1.5 to 4 percent of the purchase price, the savings could be significant.

Alternatively, you could request a price reduction. This would lower the home’s selling price based on how much you’ll need to spend on repairs. If you were planning on a significant down payment, this could free up cash for the projects you’ll need to tackle.

At times, this approach can be beneficial. After all, the seller may turn to the lowest-cost contractor for any repair work you request. By taking the work on yourself, you can make sure that you get a reputable contractor for the project, increasing the odds that you’ll be happy with the results.

Repair Requests Buyers Shouldn’t Make

There are repair or maintenance issues that buyers shouldn’t expect sellers to address. Cosmetic issues aren’t something you should expect the seller to handle, especially if they were apparent before you made your initial offer.

Additionally, problems that you can address easily and cheaply (for less than $100) on your own shouldn’t end up on the seller’s repair list. If there are several problems of this nature, you may be able to request a lower sale price. However, for only one or two, it may be best to ignore it.

What Happens with As-Is Sales

As a homebuyer, moving forward with an as-is home sale changes the equation. When a seller states that they are selling the home as-is, they are unwilling to make any repair regardless of its nature, cost, or severity. Even if there are structural, foundation, roof, electrical, plumbing, mold, mildew, or pest problems, the seller will not handle them.

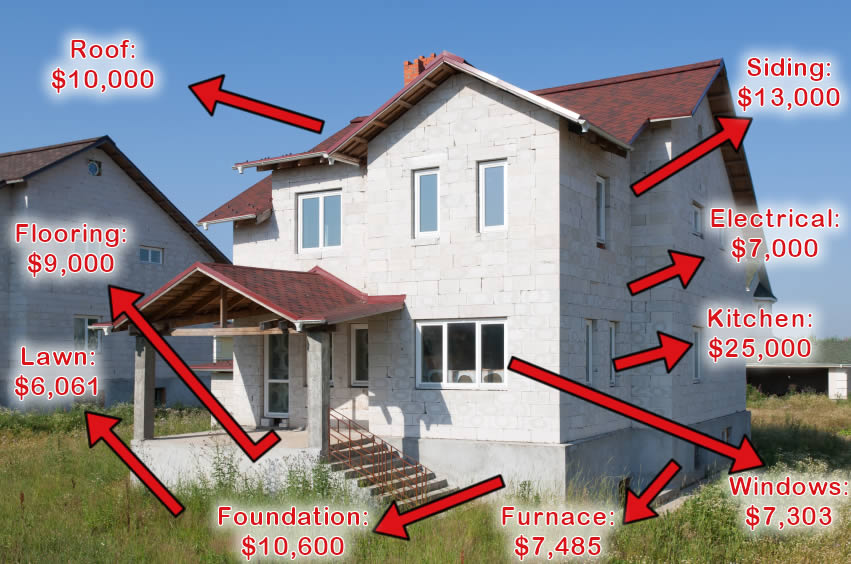

Instead, with an as-is sale, any updates have to be handled by the buyer once the purchase process is complete. Repairs can be costly. For example, asphalt roofs may cost between $2,000 and $11,000 depending on the roof size and material chosen. New plumbing pipes can run from $455 to $2,277 or more, while foundation repairs can reach up to $70,000, depending on the severity of the damage.

However, any known issues usually lead to a lower price. As a result, buyers need to factor in the potential repair costs when negotiating with the seller.