November 13, 2024

Real Estate offices, Realtors, the buying and selling processes, paperwork, disclosures and, well everything Real Estate related is overseen in BC by the BC Financial Services Authority (BCFSA)

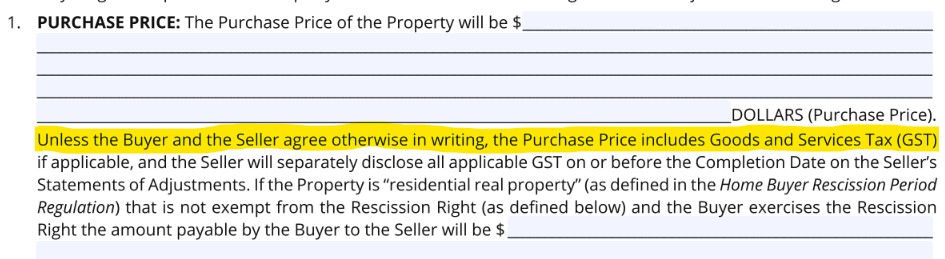

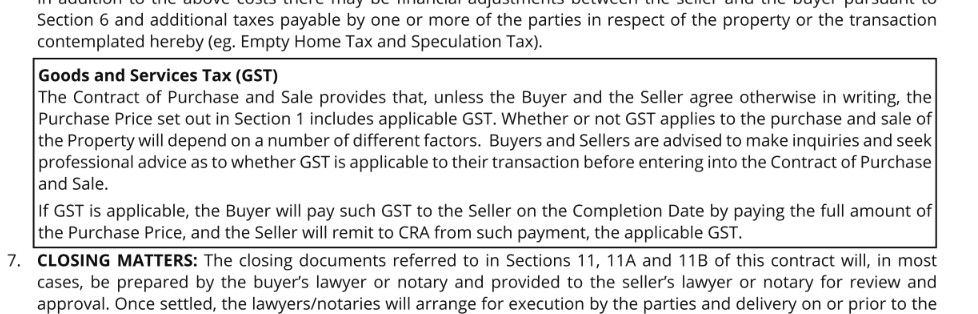

In an effort to protect both buyers and sellers, an ongoing stream of updated disclosures, new procedures and changes to the standard contracts are being handed down to us on a regular basis. This week it is a change to the standard contract of purchase and sale to include GST as a sellers expense.

“GST is automatically payable by the Seller…”

That’s right – As of Nov 12, if not separately addressed in the offer, GST is contracted to be included in the purchase price and it is the obligation of the seller to remit. The thought behind this is that the seller is in a better position to know if GST is applicable than the buyer.

In the majority of sales for previously lived in residential homes, there is no GST applicable, and this contract change is a non-issue. New homes, previously owned but never lived in homes, commercially used properties and significantly renovated homes are all subject to GST.

The difference to you, as a seller, is that unless specified otherwise – you are on the hook for the GST if it is deemed payable. The plus for buyers is that, unless specified otherwise, the contracted price is what you pay and there will be no surprise on closing day.

If you are selling – make sure that you discuss this item in detail before the listing goes live.

There is more information available here: https://www.canada.ca/en/revenue-agency/services/forms-publications/publications/gi-004/sales-individuals-owner-occupied-homes.html